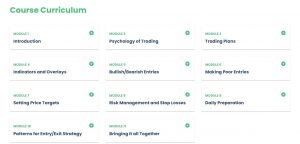

About Course:

The Zero DTE Advantage

- Introduction to the Zero DTE Advantage

- Which Assets Have Zero DTE Options?

- Zero DTE Challenges and Requirements

- The Zero DTE Advantage Summary

- The Zero DTE Advantage – Video

- Which Options Are Zero DTE? – Video

- Zero DTE Challenges and Responsibilities – Video

Zero DTE Iron Condors

- What is a Zero DTE Iron Condor?

- The High Probability (HP) Zero DTE Iron Condor

- The Low Probability (LP) Zero DTE Iron Condor

- The Expected Move (EM) Zero DTE Iron Condor

- Summary – Zero DTE Iron Condors

- What Are Zero DTE Iron Condors? – Video

- High Probability Iron Condors – Video

- Low Probability Iron Condors – Video

- Expected Move Iron Condor – Video

Zero DTE Iron Butterflies

- Introduction to Zero DTE Iron Butterflies

- The Pros and Cons of Going Narrow

- Setting the Iron Fly Width

- When Should You Enter the Trade?

- Profit Goals and Exits

- Zero DTE Iron Fly Defense

- The Iron Butterfly Active Defense (Batman Hedge)

- The Batman Hedge – Example

- A Combined Iron Fly Hedge Example

- Zero DTE Iron Butterfly – Summary

- What is an Iron Butterfly? – Video

- Why Go to the Narrow Butterfly? – Video

- Setting the Iron Butterfly Width – Video

- Iron Butterfly Profit Targets and Risk Management – Video

Zero DTE Calendar Spreads

- Introduction to Zero DTE Calendar Spreads

- When Does This Strategy Work Best?

- Offense Trade Design – Price Action

- Zero DTE Calendar Offensive Trade Entry Criteria

- Zero DTE Calendar Spread Defense

- Profit Goals and Exits

- Calendar Defense – The Finer Points

- The One DTE Calendar Spread

- Zero DTE Calendar Spread Summary

- What Are Calendar Spreads? – Video

- Advantages and Disadvantages of Calendar Spreads – Video

- Calendar Spread Entry – Video

- Calendar Spread Defense – Video

- Calendar Spread Tracking Sheet

Zero DTE DIrectional Trades

- Introduction to Directional Zero DTE Trades

- When Do Zero DTE Directional Trades Work Best?

- Offense: Trade Design

- Evaluating the Zero DTE Directional Trade Entry

- Zero DTE Directional Setups – 1

- Zero DTE Directional Setups – 2

- Profit Goals and Exits

- Zero DTE Directional Trades – Summary

- Identifying Directional Setups – Video

- Directional Entry Signals – Video

- Entering and Managing Directional Trades – Video

Zero DTE Semi-Directional Trades

- Introduction to Semi-Directional Strategies

- The Concept of Mean Reversion

- The OTM Vertical Credit Spread

- The Broken-Wing Butterfly

- Sample Broken-Wing Butterfly Trade

Zero DTE Decision-Making

- Introduction to Zero DTE Decision-Making

- Trend Day or Range Day?

- Looks Like a Range Day – Now What?

- Other Ways to Determine “Range” – Primary and Secondary Ranges

- Strategy Decision Chart

- Profit Goals and Exits

- Where Do You Go from Here?

- Developing Your Approach – Video

- Which Strategy Do You Use? – Video

- Getting Started – Video

- Sample Zero DTE Strategy Tracking Sheet – Excel

Important Disclaimer and Legal Disclaimer Information

- US Government Required Disclaimer

- 12 Minute Trading Disclaimer and Legal Rights

- 12 Minute Trading Earnings and Income Disclaimer

- 12 Minute Trading Privacy Policy

- 12 Minute Trading Terms and Conditions

Over 1.000 comments

Over 1.000 comments