About Course:

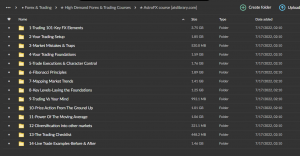

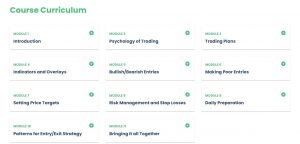

The Best Course Ever Created To Help You Dynamically Adjust Your Trades

In this one-of-a-kind course we give you a powerful set of trading rules and guidelines, designed for real-world application. Central to our approach is the decision tree method, enabling you to manage strategies effectively, regardless of market direction.In a rising market, our guidelines help maximize profits. In a downturn, they guide you to mitigate losses. In a stagnant market, our strategies show how to generate cash flow. This flexible approach allows you to tailor strategies to your needs, enhancing understanding and boosting trading confidence.

- Naked Puts: Learn how to sell put options where you’re willing to buy the stock at the strike price if it falls. This strategy can generate income and potentially buy stocks you want at a lower price.

- Dynamic Stock – Protective Puts, Covered Calls, Collars, and Cash Flow Cycle: Master the art of protecting your stocks with puts, generating income with covered calls, and combining both in a collar strategy. Understand the cash flow cycle to optimize your trading decisions.

- Long Calls: Discover the power of buying a call option when you anticipate a rise in the price of the underlying stock. This strategy offers the potential for unlimited profit while limiting your risk to the premium paid.

- Long Puts: Learn to leverage the strategy of buying a put option when you expect a stock’s price to fall. This strategy can also be used as a form of insurance to protect your stock holdings against a potential drop in price.

- Credit Spreads: Dive into the world of credit spreads, a strategy that involves buying and selling options of the same class, same expiration date, but different strike prices. This strategy can generate income and limit risk

Over 1.000 comments

Over 1.000 comments