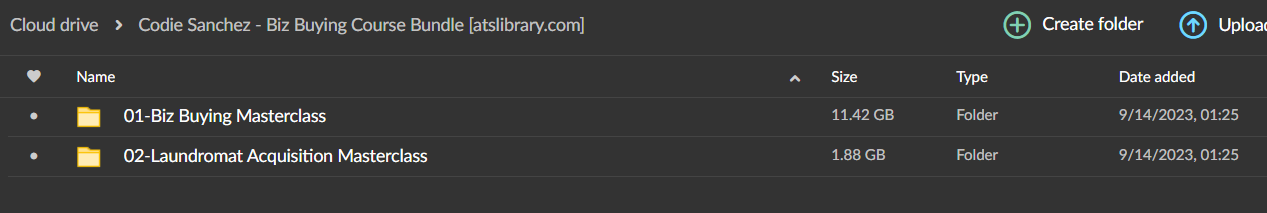

Learn How to Buy a Small Business

9UNIT COURSE

1 HOUR PER DAY FOR 30 DAYS

Learn to become a dealmaker in 30 days!

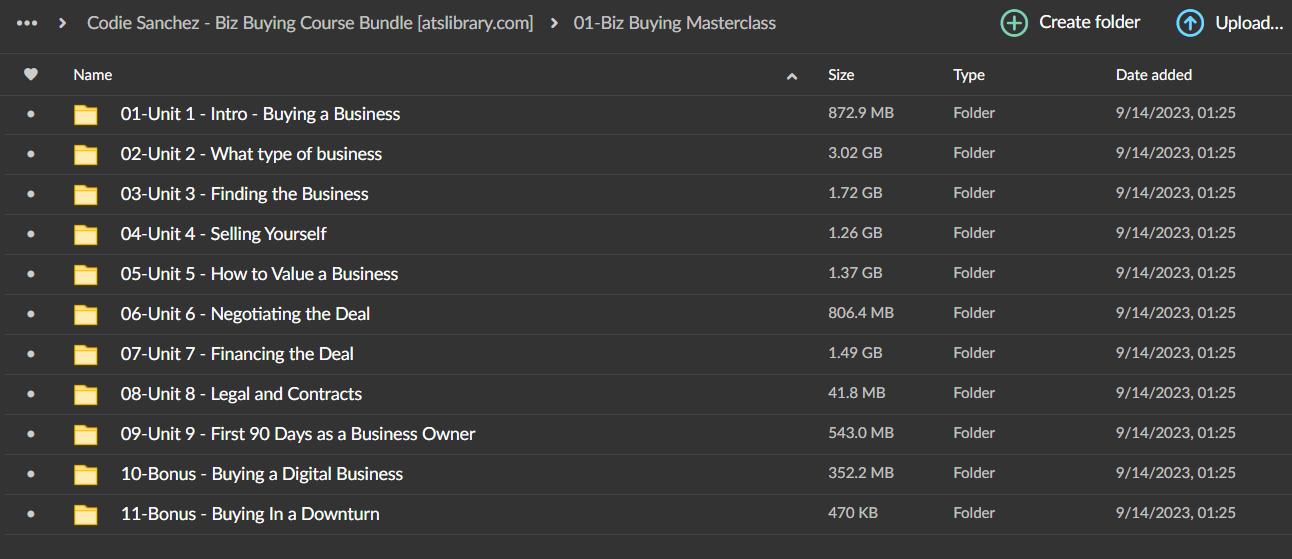

Unit 1 – Intro – Buying a Business

- Welcome to Unconventional Acquisitions

- What Will You Learn

- Why Buy a Business

- Why Now is the Time to Buy a Business

- Pros and Cons of Buying a Business

- Building Your Team

- Can I Really Buy a Business?

- Getting Prepared to Buy a Business

- Unconventional Acquisitions Personal P&L

- Unconventional Acquisitions Business Buying Calendar for Excel

Unit 2 – What type of business?

- Gaining Clarity

- Gaining Clarity Worksheet

- Characteristics of the Business

- Goals and Objectives

- Models – Services, Products, and Systems

- Field Interview: Buying Franchises with Wayne Lucier

- RESOURCE: Business Buying Checklist

- Field Interview: Matt Aitchinson – Buying Laundromats, Add-On Companies & Believing in Yourself

- 5 Worst Businesses To Buy

- 5 Best Businesses to Buy

Unit 3 – Finding the Business

- Targeting the Right Sellers

- Don’t Try to Do It All – Pick 2

- Leverage Your Network

- The FROG Method

- Roleplay Soliciting Dealflow From Friends

- Leverage Your Community

- Roleplay Reaching Out to COI’s

- Build Your Personal Brand

- Roleplay Cold Calling A Business

- Interview – Overcoming Rejection with Andrea Waltz Co-Author of Best-Seller Go for No

- How Many Businesses Do I Need To Look At

- RESOURCE: Network Email Outreach Scripts

- RESOURCE: 1-Page Seller Email Outreach

- RESOURCE: Business Broker List

Unit 4 – Selling Yourself

- Your Unique Skillset

- What’s Your Track Record

- How does the Seller Benefit?

- Business Buyer Role Play: Your First Meeting

- RESOURCE: Template NDA

- Bonus Interview with David Osborn

Unit 5 – How to Value a Business

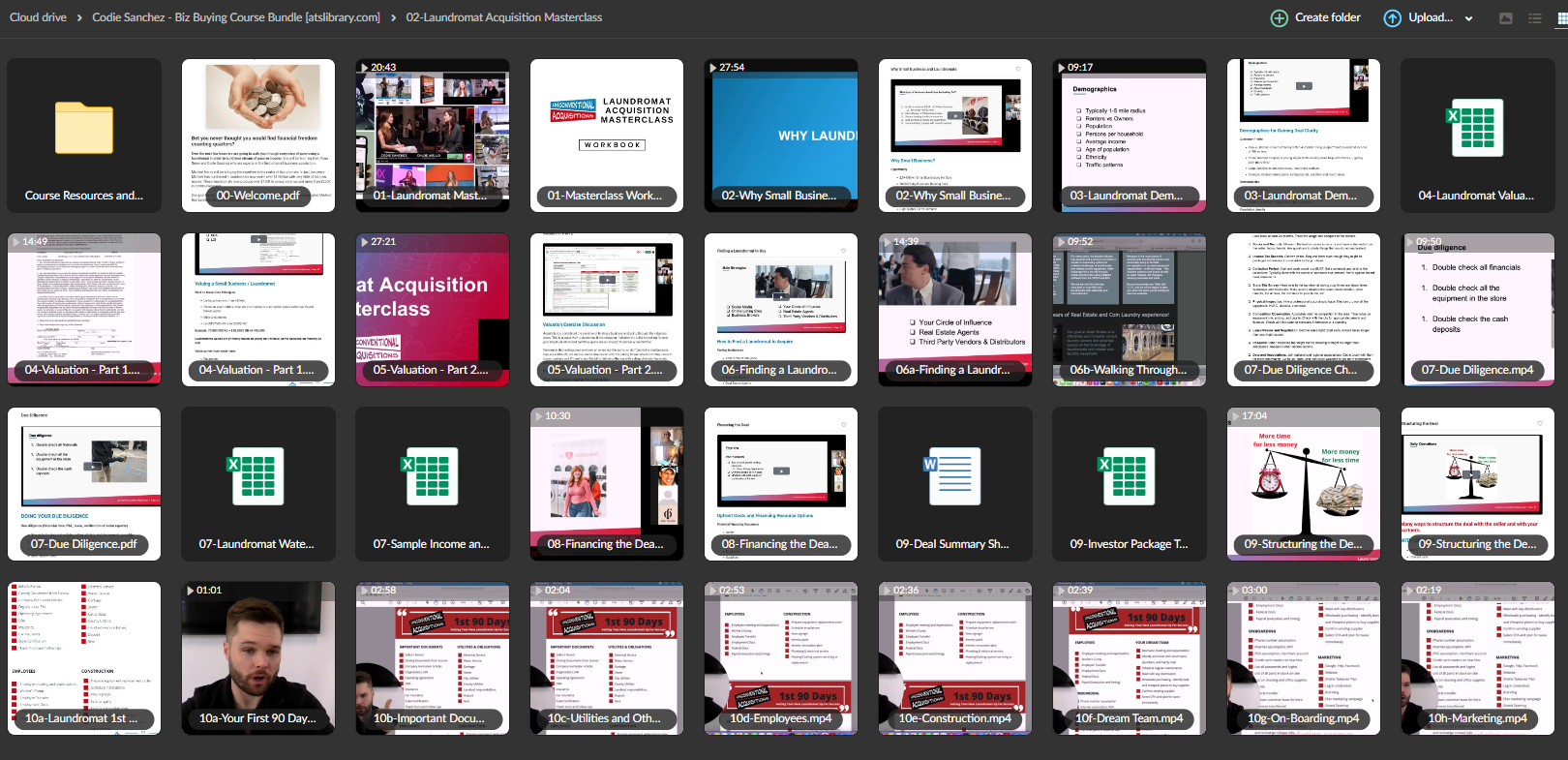

- Laundromat DD & Valuation Case Study

- How We Value Companies: KISS METHOD

- Financial Model Walk-thru

- Common Methods to Value a Company

- Value of Relationships: Valuing Customers

- The 3 M Model for Adding Value

- 5 Steps to Due Diligence Broken Down

- RESOURCES – Due Diligence Checklist and Letter of Intent

Unit 6 – Negotiating the Deal

- Two Warnings

- Seller Needs Analysis – Know Your Audience

- Levers: Negotiating Price vs Terms

- What to Bring to The Negotiation Table: Two Paths

- Determine Your Level of Competition

- Buying A Closed Business: Timely Opportunity

- RESOURCE – Term Sheet & LOI Template

- RESOURCE – 8 Questions to Ask So You Don’t Waste Time

- Interview: Negotiation Tactics to Win-Win with Mark Yegge

Unit 7 – Financing the Deal

- Financing Important Levers

- Structuring Owner Finance

- SBA Lending A Lender Interview

- Alternative Lending Sources

- Milestones & Earn-Outs

- Cash Influx – Percentage of Equity

- Investor & Operator Partnership

- Sweat Equity, Revshare, Profit Sharing

- Empire Flippers CEO: Buying An Online Business

- Case Study: Seller Financing Structure

Unit 8 – Legal and Contracts

- Financial Oversight & Access

- RESOURCE – 13 Week Cash Flow

- Most Important Legal Documents

Unit 9 – First 90 Days as a Business Owner

- The First Employee Meeting

- Hiring Your Operator

- The First 30-60-90 Days Operating the Business

Over 1.000 comments

Over 1.000 comments