Course Overview

The course focuses on leveraging the “Opening Range” (OR) — the initial price range established during the first few minutes of the trading session. Traders learn to interpret market sentiment, predict price movements, and execute trades with precision. The course covers everything from basic concepts to advanced strategies, making it suitable for beginners and experienced traders alike.

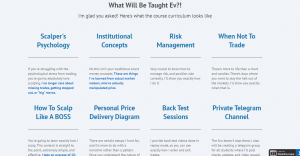

Key Learning Objectives

- Understand the concept of the Opening Range and its significance in day trading.

- Identify high-probability trade setups using OR-based strategies.

- Improve entry, exit, and stop-loss techniques for better risk management.

- Utilize market sentiment analysis to gain an edge in volatile markets.

- Master the tools and indicators essential for OR trading.

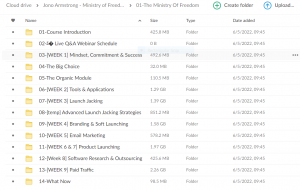

Course Structure

The Opening Range Success Formula is structured into clear, digestible modules. Each module builds on the previous one, ensuring a gradual progression from foundational concepts to advanced trading strategies. The content includes:

- Introduction to the Opening Range

- Definition and importance of the OR in day trading.

- How market behavior during the OR impacts the rest of the trading day.

- Overview of key trading principles.

- Essential Tools and Indicators

- How to set up charts to visualize the Opening Range.

- Overview of technical indicators and how they complement OR trading.

- Introduction to MarketGauge’s proprietary trading tools.

- Core Trading Strategies

- Breakout Strategies: How to profit from price breaks above or below the OR.

- Reversal Strategies: Identifying potential reversals within the OR.

- Continuation Strategies: Capturing momentum-driven moves after the OR is set.

- Risk Management and Trade Execution

- Setting precise entry, exit, and stop-loss points.

- How to size positions effectively to protect capital.

- Tips on maintaining discipline and avoiding emotional trading.

- Advanced Techniques and Customization

- Advanced OR trading tactics to handle different market conditions.

- Customizing OR strategies for different asset classes (stocks, forex, futures, etc.).

- Adapting the OR strategy for long-term success.

Benefits of the Course

- Time-Efficient Strategy: Traders can focus on a short but critical period of the trading day.

- Clear, Actionable Tactics: Simple, repeatable methods are taught to identify and execute profitable trades.

- Risk Reduction: By honing in on a specific window of time, traders can limit exposure to unpredictable market conditions.

- Applicable Across Markets: The principles apply to stocks, forex, futures, and other asset classes.

Who Should Take This Course?

This course is suitable for:

- Beginner Traders looking to build a strong foundation in day trading.

- Intermediate and Advanced Traders seeking to refine their opening range strategies.

- Busy Professionals who want to capitalize on a short trading window.

The Opening Range Success Formula by Geoff Bysshe provides a systematic approach to mastering the crucial first 30 minutes of the trading day. By learning to capitalize on the OR, traders can make more informed, timely decisions and potentially boost their profitability. With practical tools, clear strategies, and risk management techniques, this course is a must-have for anyone serious about short-term trading success.

Over 1.000 comments

Over 1.000 comments