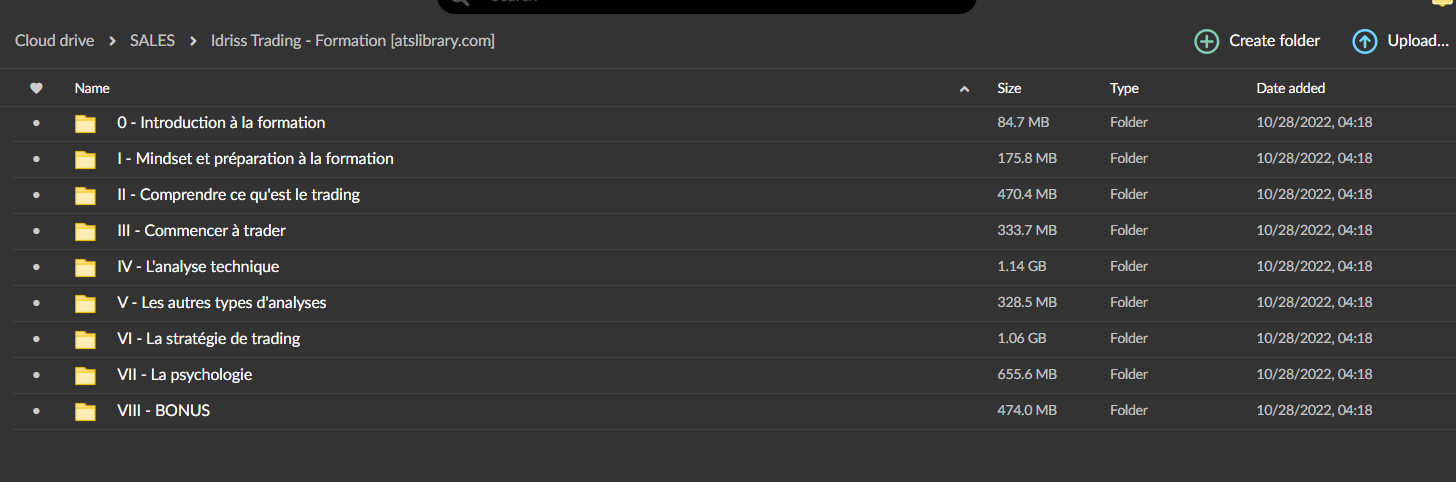

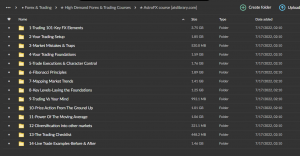

“IT TRAINING IS THE BEST FRANCOPHONE TRADING TRAINING”

What you will find in the training:

Introduction to training

- Introduction to training(2:35)

I – Mindset and training preparation

- 1: Training is a tool that will help you in your learning process(17:03)

- 2: Persistence is the key(17:31)

- 3: You are more likely to fail(15:52)

- 4: Trust the process(21:46)

- 5: Join the group(7:16)

II – Understanding what trading is

- 1: What is trading?(16:26)

- 2: The different assets(34:15)

- 3: Platforms(13:51)

- 4: Brokers(13:24)

- 5: Forex and charts(25:25)

- 6: Candles and timeframes(18:56)

- 7: Spread and pips(17:40)

- 8: Leverage(6:05)

- 9: Material(7:52)

- 10: The economic calendar(11:44)

III – Start trading

- 1: Use tradingview well(24:23)

- 2: Simulation trading.(11:36)

- 3: How to take a position in the market(7:47)

- 4: How to close a trade(6:05)

- 5: Stop loss and take profit orders(20:04)

- 6: Conditional orders(14:51)

IV – Technical analysis

- 1: Markets are not predicted(3:24)

- 2: What is technical analysis(6:11)

- 3: The basics of price action(12:19)

- 4: Supports & resistances(20:55)

- 5: Trends(14:30)

- 6: Trendlines(15:52)

- 7: Japanese candlesticks(10:38)

- 8: Continuation Patterns(27:09)

- 9: Turnaround figures(20:34)

- 10: Optimize the reading of figures(18:01)

- 11: Extreme points (Higher High, Higher Low, Lower Low, Lower High)(22:09)

- 12: Fibonacci retracements and extensions(30:15)

- 13: Elliott’s Waves(26:08)

- 14: Indicators(5:40)

- 15: ROI(14:52)

- 16: Moving Averages(14:19)

- 17: Volumes(21:35)

- 18: Volume profiles(19:15)

V – Other types of analysis

- 1: Introduction(3:26)

- 2: Currency indices(29:59)

- 3 – Intermarket correlations(25:28)

- 4: Market seasonality(9:27)

- 5: The basics of fundamental analysis(39:24)

VI – The trading strategy

- 1: Introduction(3:11)

- 2: Risk management(33:15)

- 3: Money management(27:48)

- 4: Taking correlations into account(23:20)

- 5: Draw-up and Draw-down management(24:22)

- 6: The desired entry(24:54)

- 7: Multitimeframe analysis(22:12)

- 8: Trade management(29:19)

- 9: Doubling a trade(22:36)

- 10: The trading plan(23:22)

- 11: Learn from mistakes(12:23)

- 12: Track your performance(24:26)

- 13: My trading strategy(29:56)

VII – Psychology

- 1: Introduction(4:18)

- 2: The importance of psychology in trading(24:03)

- 3: The problem of trading(16:30)

- 4: The dynamics of psychology in trading(21:03)

- 5: The market is neutral(19:14)

- 6: Anything can happen(9:53)

- 7: Thinking in terms of probabilities(21:03)

- 8: Stay in the present moment(16:56)

- 9: Embrace the right psychology(14:46)

- 10: Summary of Good Psychology(12:49)

- 11: The objective(9:20)

- 12: Some concrete examples(31:42)

VIII-BONUS

- All useful links

- My favorite books

- 1: Use trendlines well(23:12)

- 2: Examples of my trades(50:11)

- 3: The new track record(10:53)

- 4: High spread moments(24:47)

- 5: Friday(15:57)

- 6: My routine and my way of analyzing for a week(234:25)

- 7: Discount for training members in the analysis and sharing group(19:29)

- 8: The optimization of the analysis(17:34)

- 9: Example of an optimized trade(29:05)

- Case study: Trading data (news) efficiently(22:39)

IX – Cryptocurrencies

- 0: Intro(5:21)

- 1: The general context(18:54)

- 2: Cycles of speculative bubbles(38:08)

- 3: Lags between cryptocurrencies(20:50)

- 4: Big players and their limits(26:16)

- 5: General opinions(24:58)

- 6: My practical techniques for generating money(93:56)

- 7: Size trades well(19:39)

- 8: The dangers of cryptocurrencies(34:00)

IT TRAINING

In this training I explain all my trading strategy in a detailed, structured and understandable way!

Over 1.000 comments

Over 1.000 comments