A conservative income options strategy to use with SPX or RUT. This income options trade uses a broken wing butterfly spread to capture the time premium (options time decay). Works very well with the Ride Trade. A key strategy of my Hedge Fund. This is the most discretionary of all my options strategies as it may use some technical analysis to better position the structure at open. The target profit is 10%-15% per trade.

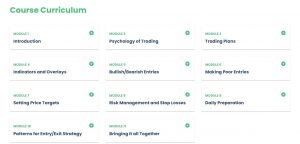

Contents

SPX Best Options Strategy Course

- 6.9 MB

Description

Note: This course includes a pdf with the strategy description and instructions. I am trading every month this strategy. You can learn and follow all my Trades by subscribing to the Trading Community.

Buying this course and you will ACCESS …

… a proven and profitable options strategy;

… a faster way to learn options trading skills from a trader and instructor;

… a real options trading strategy that produces sustainable income;

————————————————————————————————–

Strategy live performance (until Mar 24):

In 2021 (starting in October) and the difficult trading times of 2022, the trade produced 10 wins in 15 trades opened (70% win rate). Until March 24, the performance increased to 27 wins, over 31 trades opened (historically, is circa 87% win rate). Each positive trade delivered an average profit of $770. Considering an average of $5000 investment per trade, the return is roughly 17% per month (each trade is opened about 1 to 1.5 months). Most of my Hedge Fund performance comes from this strategy.

————————————————————————————————

Are you tired of high-risk trading strategies that leave you anxious about market movements? Look no further!

Our SPX Best Options Strategy is designed for the savvy investor looking to generate consistent income with minimal risk!

Watch the Video strategy presentation… until the END (for a surprise!)

The SPX Best options strategy focuses on achieving a Delta Neutral position, adapting as per market conditions to ensure your investments remain steady or even slightly positive. We leverage the unique structure of this strategy to minimize price fluctuations in the SPX, while profiting from options time decay and potential IV decreases.

What sets this options strategy apart is its flexibility. We empower you to make adjustments based on simple technical analysis judgments, all within a conservative model. But don’t be fooled by our conservative approach – the SPX Best Strategy can also be a fierce contender when market conditions present an attractive IV level, such as during a correction.

With the power of choice at your fingertips, this strategy requires more discretion than others you might have encountered. You can harness the wisdom of Support/Resistance lines to optimize your short strikes within a Broken Wing Butterfly. Plus, selecting the right options chains to support your trading strategy hinges on the IV level and your desired level of aggressiveness.

The SPX Best Options Strategy brings you to positive Theta, ensuring you can stay stress-free as time passes. Much like a well-crafted piece of art, our strategy thrives with time, capturing profits as it matures.

The trade structure aims to manage a wide interval, where the price can fluctuate, to deliver enough Theta and maintain Delta under control.

I am actively trading this strategy which is delivering exceptional results. You can follow all my trades in the Trading Community, which also includes access to a live trading room (Discord Channel) where you can interact with me. The trades are announced there when I enter them into the trading platform.

This options management style can be implemented with a minimum suggested account value of USD4000.

————————————————————————————————–

Why you should consider buying this options strategy?

You should buy this strategy if you’re tired of struggling to achieve consistent profitability in your trades, this option strategy is a great enhancement for you. No more theoretical courses or false promises of miracles that never come true. I understand your frustration (I was on that side also) and have crafted a practical, results-driven approach that is delivering great results in real markets.

Whether you already possess basic options knowledge or are new to the game, this options strategy will empower you to make confident decisions and seize profitable opportunities. Say goodbye to confusing technical analysis that fails to deliver… or don’t be held back by unreliable trading indicators anymore.

My powerful strategy cuts through the noise and delivers consistent, profitable results.

Join countless satisfied option traders who have transformed their trading journey with our options strategy and become consistent winners in the markets.

Take action now investing in knowledge, securing your success and providing an extra income!

Over 1.000 comments

Over 1.000 comments